Just what credit rating can i re-finance a car or truck?

Shopping for an alternative car loan barely happens as opposed to because of the matter, Exactly what credit history is good to re-finance an automobile? This short article have a tendency to falter everything you need to know about they!

If you think there was the quintessential golden’ number one functions as just the right credit score, you’re in getting a surprise! The reality is that i don’t have a unitary credit rating or diversity you really need to refinance an automible.

Credit ratings are merely one to the main refinancing techniques. There are many different loan providers exactly who focus on different borrowers all with assorted criteria. Quite simply, the response to practical question What credit score must refinance an auto? can vary from team to another.

Is credit rating truly the only basis to help you re-finance my vehicle?

If you are your credit score is an important reason for vehicle refinancing, it is really not the only person that identifies what Annual percentage rate you get. There are other requirements you to select the new interest, like:

1. The loan number: Have you been probably re-finance the entire amount borrowed, or are you presently to make a deposit? Based on you to definitely, your own interest can vary.

dos. Mortgage label: Choosing an extended financing title can help you score a lower refinance Apr and vice versa. That’s because the lender can also be earn significantly more appeal as a consequence of a lengthier loan term, even as slashing rates to you personally in the short term.

step three. Period of the auto: Loan providers will not generally refinance car avove the age of ten years. There is certainly particular lenders ready to re-finance to fifteen ages however with higher interest levels.

cuatro. The credit get of the co-signer otherwise co-borrower: Refinancing which have a reduced Apr will be simpler when you yourself have a good co-signer having good credit. In the approval process, the co-signer’s get will be presented much more weightage compared to no. 1 debtor.

5. Work reputation: Having a long-term otherwise government jobs mode you could score lower rates of interest because of a lesser likelihood of standard. Likewise, becoming care about-functioning otherwise which have a great contractual employment could suggest large APRs having you.

Tend to a poor credit get end me personally out-of refinancing my car?

Simply because you have got a bad credit get does not always mean you will never select loan providers so you’re able to re-finance. Of numerous loan providers deliver borrowers financing in the event the score is a lot lower than 600. Although not, you might have to bring about an excellent co-signer, generate a much bigger down-payment, or invest in adjustable interest rates in order to refinance having bad credit.

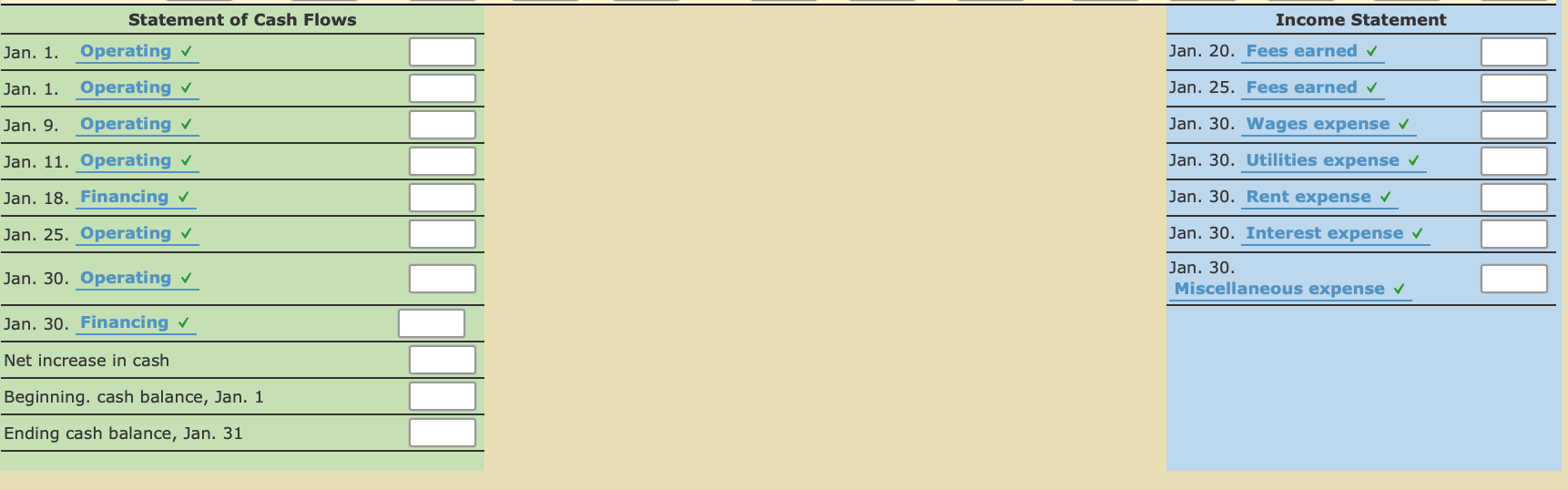

Feeling out of credit score on your loan application

Credit scores appear to be associated with a false feeling of coverage. Some one seem to accept that the credit score ‘s the only grounds choosing whether or not they get an effective car re-finance deal. Even though it is not necessarily the just planning, it can impact the rate of interest you get. The entire rule is the fact that the highest your credit rating, the greater number of your odds of researching a lowered interest rate.

More borrowing from the bank selections getting a knowledgeable APRs

It’s just not very easy to see and therefore rating model to make use of since the there are plenty. Concurrently, loan providers appear to think about your FICO score put into groups.

- 850-800: Outstanding

- 799-740: Decent

- 739-670: A beneficial

- 669-561: Reasonable

- 560-300: https://cashadvancecompass.com/installment-loans-mo/richmond Bad

Is there a minimum credit history in order to refinance a car loan?

Getting refinancing your own auto loan, there’s absolutely no put minimal credit history. Additional loan providers has actually different criteria, and lots of loan providers focus on coping with readers that have bad borrowing, like those who have had bankruptcies or repossessions.