DSA Mortgage Broker Subscription Online System 2022

23. julij, 2024

On line DSA Mortgage Representative Subscription experts DSA Financing representative membership on line system available for Pan Asia locations, possibility to secure high payment, 100% electronic processes offered, few financial products having loans and you will credit cards, insurance coverage facts, mutual financing and even more services readily available for sourcing to own DSA mortgage agents at DOL Partner mobile app and you will DOL CRM motor.

Lead Handling Design to own DSA Loan Lender representative Prospecting is actually very easy now having complex DOL Spouse application, this can be you to definitely for all included cellular programs with various banks and you will loan providers electronically, now generate prospects, take a look at instantaneous qualified banks & pick bank for log on, submit software and have decision alive, DSA is also track, inform, change and erase their leads given that good admin by itself.

Who can Initiate Mortgage DSA on the web: Anyone out of one areas can come towards the Financing Organization, generally people from Loan Opportunities are coming to own DSAs, several come from financial markets having junior/elder name sense. Below are because of the first examples of procedures that will explore financing DSA.

Even more brand of industry’s anybody may start the borrowed funds dsa business at home/ work environment, just need the effort and commitment to your vision

Present Bank Team Ex boyfriend. Financial Group LIC and other Insurance professional Real estate agents Hour director/ Hours Managers Electronic Income People Digital Selling Professionals Chartered Accountant Tax Consultant/ Tax Auditors Direct selling Organizations/ Agents Any Group Other organization couples

DOL website is actually incepted this present year, nearly ten years regarding winning journey in the Indian on the web monetary markets with high market profile, a great deal of DSAs had been acquired commission off DOL punctual, India’s largest digital mortgage provider, which have presence within the more than 700 metropolises inside India, Most advanced technology, APIs & rotices provider based CRM Motor & Companion Application in regards to our station couples in the free. Improve algorithm & produced in lender smart policy parameter to get immediate choice. Advanced Lead filtering possibilities included that have Equifax/ Credit Bureau, to find complete credit rating or any other borrowing from the bank advice. Electronic Application Running system in order to processes quickly and you may make immediate decisions out-of individuals banks/ NBFCs alive of the self service customized possibilities instead delivering assistance throughout the DOL group. Build your digital store because they build your community from inside the CRM and stimulate the newest administrator handle feature. Opportunity to have a look at immediate eligibility of certain banking companies/ NBFCs in a few minutes.

Initiate Loan DSA Business online having Dealsofloan Before it absolutely was extremely tough because of the enough critical techniques and you can regularisations, other than busy techniques work of to start that loan dsa is now very easy because away from Dealsofloan Financing DSA program, DOL brought an excellent possible opportunity to become your individual manager and start and place the loan dsa company effectively, checkout new action smart subscription package according to here.

Checkout Very first Lead generation Travels Simply take verification in the buyers prior to beginning electronic application for the loan, customer might get OTP/ hook up out-of particular Bank/NBFCs or Dealsofloan for Borrowing from the bank Agency generation request

DOL Spouse Membership Travels Done the sphere off DSA Software and you may fill out today. Would user id & code given in the acceptance send. Complete their KYC procedure & publish your own KYC data. Start brief report about DOL CRM/ Mate Application Checkout DSA Give book to possess Product & Procedure Studies Knowhow the fresh new digital direct handling in various Banking institutions/ NBFCs

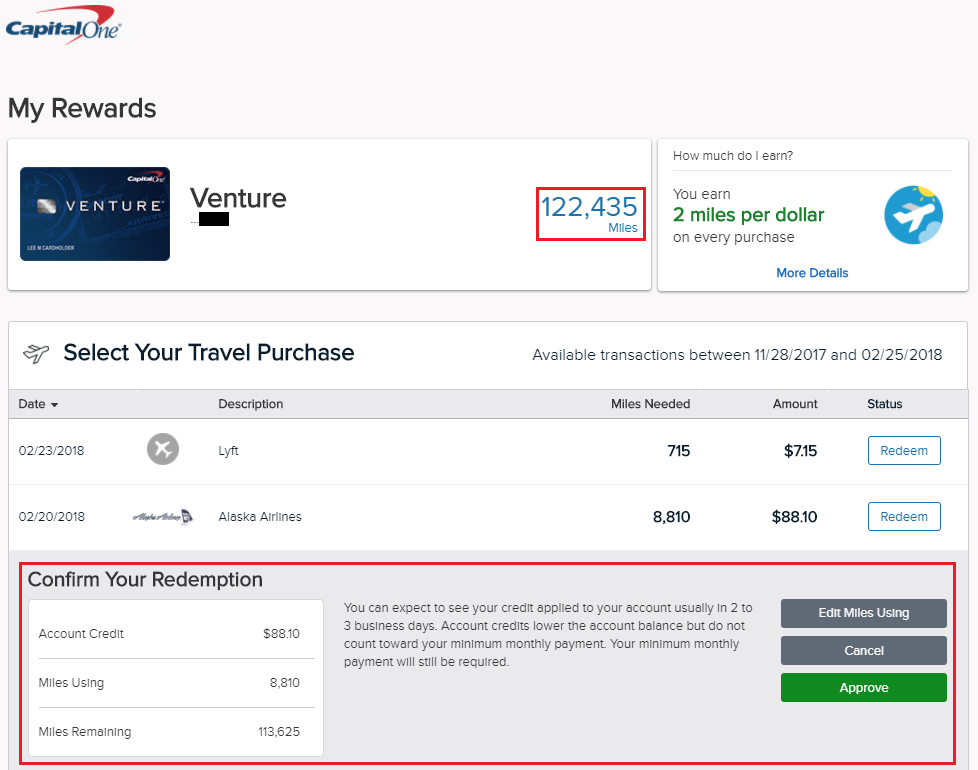

Incorporate basic lead outline & look at your direct eligibility out of offered all the banks/ NBFCS & complete today, checkout quick Qualified/Not Qualified reputation that have need Immediately following checking the guides qualification, done all software areas according to the data, best and you can over as opposed to mistake. Discover qualified financial and you will fill in login within the chose bank, get instant response since the eligible/ perhaps not eligible/ not as much as Processes/ Smooth Acknowledged/ Deny in real time. Upload customers’ legitimate file during the PDF structure web sites, brush & Noticeable as per the bank smart necessary records record. Records have to be read securely, cropped and you will devoid of almost every other records images and you can fill out. Tune App, when the got one borrowing inquire, complete the exact same, publish & complete. Rating Tough Accepted / Last Recognition / Borrowing Refute with different explanations Application for the loan Disbursed away from Lender/ NBFCs Track Commission Updates & Got Paid down as per the payout cycle electronically.